Accounting and Bookkeeping module for Perfex CRM With Lifetime Update.

$16.90

| Features | Values |

|---|---|

| Version | v1.1.6 |

| Last Update | 21 June 2022 |

| Premium Features | Yes |

| Instant Installation Support | 24 Hrs. |

| Scanned By Virus Total | ✅ |

| Live Preview | 100% Working |

Accounting involves recording and tracking financial statements to assess the financial status of an entity. This includes inputting, sorting, measuring, and communicating transactions in various formats. It encompasses bookkeeping, which records transactions like purchases, sales, and receipts, and analysis, which involves organizing transactions into reports like profit/loss statements and cash flow reports. Proper small business accounting provides clarity on finances, enabling better decision-making based on available resources.

Module Features

- Dashboard: Profit & Loss Chart, Income Chart, Expense Chart, Cashflow Chart and Bank Accounts Overview

- Banking:

- Banking Register

- Posted Bank Transaction

- Reconcile Bank Account

- Import Bank Transacions

- Transactions:

- Mapping Bank Statements to Accounting

- Mapping Invoices to Accounting

- Mapping Payments to Accounting

- Mapping Expenses to Accounting

- Mapping Purchase to Accounting (need to integrate with Purchase Management module)

- Mapping Inventory to Accounting (need to integrate with Inventory Management module)

- Mapping Payroll to Accounting (need to integrate with HR Payroll module)

- Item Mapping Setup

- Expense Category Mapping Setup

- Tax Mapping Setup

- Purchasing Mapping Setup

- Inventory Mapping Setup

- Banking Rules: to automatically categorize transactions

- Journal Entry: to record transactions in the general ledger

- Transfer: to transfers of amounts between accounts

- Chart of Accounts: is a list of the account numbers and names relevant to your company. Typically, a chart of accounts will have four categories (Asset accounts, Liability accounts, Income accounts and Expense accounts).

- Reconcile: is the process of matching transactions entered into module against your bank or credit card statements

- Budgets Management: supports preparing budgets, which help you monitor, track, and compare expected income and expenses with actual income and expenses. When you prepare a budget, you typically prepare it for a fiscal year, and you can opt to supply budget amounts or use historical amounts

- Business Overview Reports:

- Balance Sheet Comparison: what you own (assets), what you owe (liabilities), and what you invested (equity) compared to last year.

- Balance Sheet Detail: a detailed view of what you own (assets), what you owe (liabilities), and what you invested (equity).

- Balance Sheet Summary: a summary of what you own (assets), what you owe (liabilities), and what you invested (equity).

- Balance Sheet: what you own (assets), what you owe (liabilities), and what you invested (equity).

- Custom Summary Report: a report you build from scratch. With more options to customise.

- Profit and Loss as % of total income: your expenses as a percentage of your total income.

- Profit and Loss Comparison: your income, expenses, and net income (profit or loss) compared to last year.

- Profit and Loss Detail: profit and Loss Detail

- Profit and Loss year-to-date comparison: your income, expenses, and net income (profit or loss) compared to this year so far.

- Profit and Loss: your income, expenses, and net income (profit or loss). Also called an income statement.

- Statement of Cash Flows: cash flowing in and out from sales and expenses (operating activities), investments, and financing.

- Statement of Changes in Equity: statement of changes in equity.

- Bookkeeping Reports:

- Account list: the name, type, and balance for each account in your chart of accounts.

- Balance Sheet Comparison: what you own (assets), what you owe (liabilities), and what you invested (equity) compared to last year.

- Balance Sheet: what you own (assets), what you owe (liabilities), and what you invested (equity).

- General Ledger: the beginning balance, transactions, and total for each account in your chart of accounts.

- Journal: the debits and credits for each transaction, listed by date.

- Profit and Loss Comparison: your income, expenses, and net income (profit or loss) compared to last year.

- Profit and Loss: your income, expenses, and net income (profit or loss). Also called an income statement.

- Account history: account history

- Recent Transactions: Transactions you created or edited in the last 4 days.

- Statement of Cash Flows: cash flowing in and out from sales and expenses (operating activities), investments, and financing.

- Transaction Detail by Account: transactions and total for each account in your chart of accounts.

- Transaction List by Date: A list of all your transactions, ordered by date.

- Trial Balance: this report summarises the debit and credit balances of each account on your chart of accounts during a period of time.

- Sales Tax Reports:

- Tax Detail Report: This report lists the transactions that are included in each box on the tax return. The report is based on accrual accounting unless you changed your tax reporting preference to cash basis.

- Tax Liability Report: How much sales tax you’ve collected and how much you owe to tax agencies.

- Tax Summary Report: This report shows you the summary information for each box of the tax return. The report is based on accrual accounting unless you changed your tax reporting preference to cash basis.

- Sales and Customers Reports:

- Deposit Detail: your deposits, with the date, customer or supplier, and amount.

- Income by Customer Summary: your income minus your expenses (net income) for each customer.

- Expenses and Suppliers Reports:

- Cheque Detail: The checks you’ve written, with the date, payee, and amount.

- Budgets Reports:

- Budget overview: this report summarises your budgeted account balances.

- Profit and Loss Budget vs Actual: this report shows how well you are meeting your budget. For each type of account, the report compares your budgeted amounts to your actual amounts.

- Profit and loss budget performance: this report compares actual amounts to budgeted amounts for the month, the fiscal year to date, and the annual budget.

- Accounts Aging Reports:

- Accounts Receivable Aging Summary: unpaid balances for each customer, grouped by days past due.

- Accounts Receivable Aging Detail: unpaid invoices, grouped by days past due.

- Accounts Payable Aging Summary: the total amount of your unpaid bills, grouped by days past due.

- Accounts Payable Aging Detail: your unpaid bills, grouped by days past due.

- Banking Reports:

- Bank Reconciliation Summary

- Bank Reconciliation Detail

- Settings:

- General

- Account Detail Types Management

- Plaid API Setup

🌟100% Genuine Guarantee And Malware Free Code.

⚡Note: Please Avoid Nulled And GPL PHP Scripts.

Only logged in customers who have purchased this product may leave a review.

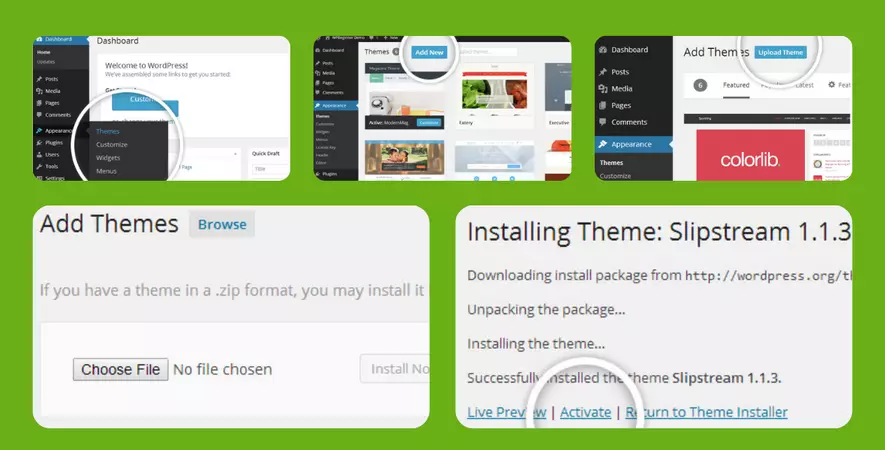

WordPress Theme Installation

- Download the theme zip file after purchase from CodeCountry.net

- Then, log in to your WordPress account and go to Appearance in the menu on the left of the dashboard and select Themes.

On the themes page, select Add New at the top of the page.

After clicking on the Add New button, select the Upload Theme button.

- After selecting Upload Theme, click Choose File. Select the theme .zip folder you've downloaded, then click Install Now.

- After clicking Install, a message will appear that the theme installation was successful. Click Activate to make the theme live on your website.

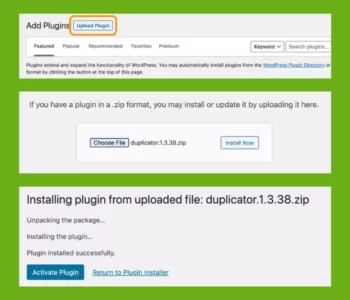

WordPress Plugin Installation

- Download the plugin zip file after purchase from CodeCountry.net

- From your WordPress dashboard, choose Plugins > Add New

Click Upload Plugin at the top of the page.

Click Choose File, locate the plugin .zip file, then click Install Now.

- After the installation is complete, click Activate Plugin.

This certificate represents that the codecountry.net is an authorized agency of WordPress themes and plugins.

Reviews

There are no reviews yet.